24

24.1 Introduction

LEARNING OBJECTIVES

- Examine the three primary chapters of the federal bankruptcy code affecting businesses.

- Compare and contrast the different types of bankruptcies.

- Explore the priority of payment of debts in a bankruptcy estate.

Bankruptcy occurs when an individual or business is financially unable to pay off debts and meet financial obligations. Bankruptcy is a proceeding under federal law in which an individual or business is relieved of most debts and undergoes a court-supervised reorganization or liquidation for the benefit of the creditors. Bankruptcies may be either voluntary or involuntary. A voluntary bankruptcy is a proceeding initiated by the debtor. An involuntary bankruptcy is a proceeding initiated by creditors to force the debtor to be legally declared bankrupt so the creditors may recover their assets.

The purpose of bankruptcy is to preserve as much of the debtor’s property as possible and to divide it as fairly as possible between the debtor and creditors. Bankruptcy encourages businesses to take risks and engage in entrepreneurial activities. It ultimately allows debtors in difficult financial situations to have a fresh start financially. However, critics allege that it allows some businesses to avoid the consequences of their mistakes and mismanagement. The United States has the highest bankruptcy rate in the world, with individuals filing for bankruptcies more frequently than businesses.

24.2 Types of Bankruptcy

There are three main types of bankruptcy under the federal bankruptcy laws that impact businesses the most. They are identified by the chapter number in the bankruptcy code. Regardless of the type of bankruptcy, there are some important terms under bankruptcy law. A debtor is the individual or business entity who owes money to others. Debtors either file a bankruptcy petition (in a voluntary bankruptcy) or a petition is filed against them (in an involuntary bankruptcy). A claim is the right of payment from the debtor. A creditor is an individual, business or governmental entity to whom money is owed by the debtor. Therefore, a creditor has a claim against the debtor.

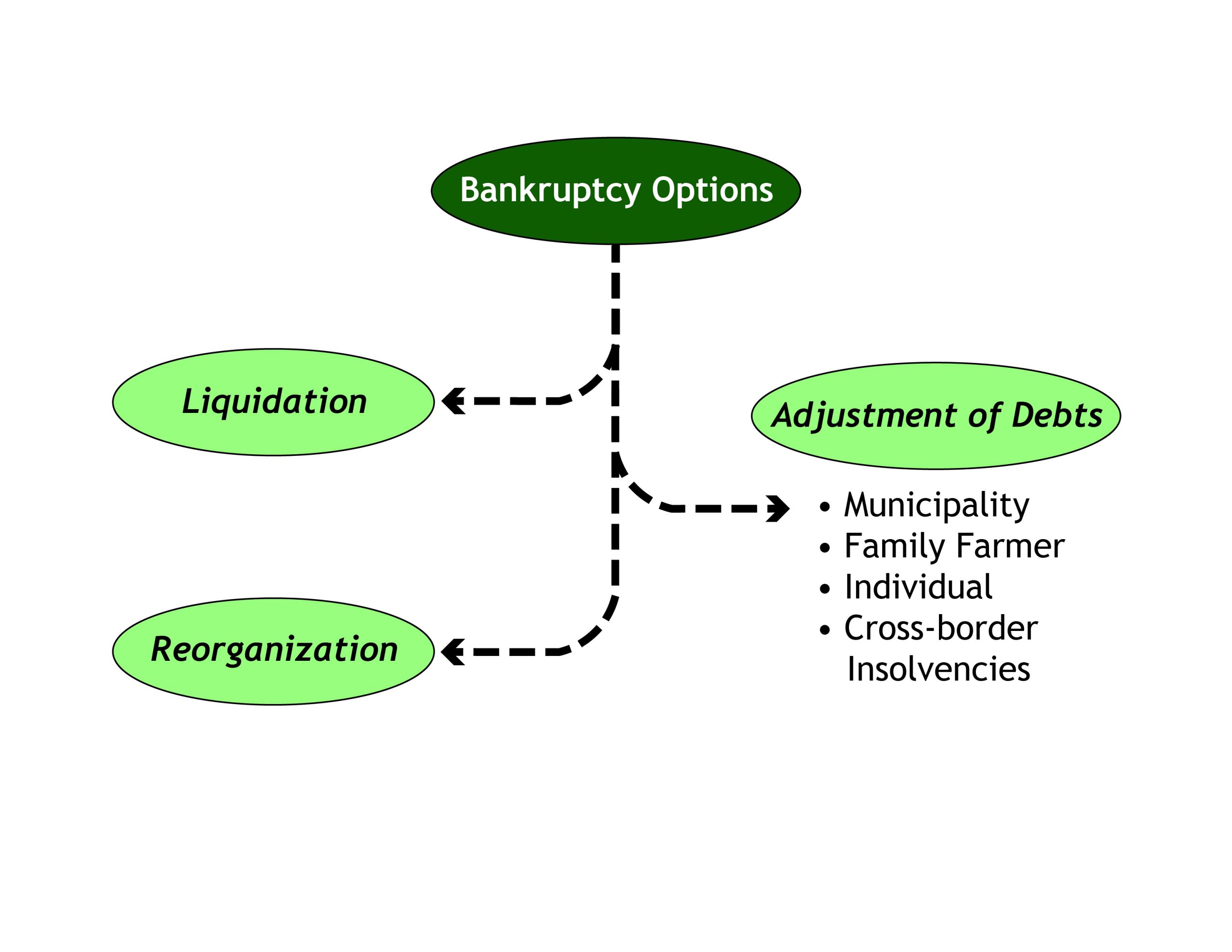

Figure 24.1 Types of Bankruptcy

Chapter 7 of the bankruptcy code involves the liquidation of an individual’s or business’s assets to satisfy creditor claims. The debtor loses most, if not all, of current assets but keeps all future earnings free of claims by current creditors. Chapter 7 bankruptcy results in the end of the current business entity.

Chapters 11 and 13, on the other hand, aim to reorganize and rehabilitate the debtor. Chapter 11 may apply to either an individual or business entity, while Chapter 13 only applies to individuals. Under Chapter 11, businesses continue to operate and their creditors are entitled to a portion of both current and future assets and earnings.

| Chapter 7 | Chapter 11 | Chapter 13 | |

| Objective | Liquidation | Reorganization | Reorganization |

| Type of Debtor | Individual & business | Individual & business | Individual |

| Voluntariness | Voluntary or involuntary | Voluntary or involuntary | Voluntary |

| Who Distributes Assets | Trustee | Debtor | Trustee |

| Who Selects Trustee | Creditors or US Trustee Program | —– | US Trustee Program |

| Who Proposes Plan | —– | Debtor & creditors | Debtor |

| Creditor Approval Needed? | No | Creditors can vote but court retains power to approve plan without creditor approval | No |

| Future Income | Debtor keeps all future income | Debtor must pay debts under court approved plan | Debtor must pay debts under court approved plan |

To prevent individuals and businesses from using bankruptcy as a tool to avoid all negative financial situations, the law requires waiting periods between bankruptcy filings. In other words, a debtor must wait a certain amount of time before being able to file for bankruptcy again.

| First Bankruptcy Case | To File under Chapter 7, must wait: | To File under Chapter 13, must wait: |

| Chapter 7 | 8 years | 4 years |

| Chapter 11 | 8 years | 4 years |

| Chapter 13 | 6 years | 2 years |

Chapter 7 Liquidation

Under Chapter 7 of the bankruptcy code, most or all of a debtor’s assets are liquidated and used to satisfy creditor claims. Liquidation is the process of converting assets into cash to settle debts. Under Chapter 7, liquidation includes winding up the affairs of a business entity because it will no longer exist after the bankruptcy is complete. As a result, discharge of debts under Chapter 7 applies to all debts incurred before bankruptcy was filed.

Before filing for Chapter 7 bankruptcy, individual debtors must meet two requirements:

- The individual must receive credit counseling from an approved agency within 180 days before filing for bankruptcy; and

- The individual must financially qualify under the Department of Justice’s means test.

The means test for individuals is complex and dependent on the median income in the state where the individual debtor resides.

Chapter 7 has some advantages for debtors. The first is that it immediately protects them from collection efforts and wage garnishments from creditors. The exception to this is child support. Regardless of the status of other creditors, the law prioritizes the right of children to receive financial support from their parents. A second advantage is that most income received after the bankruptcy filing date is not part of the bankruptcy estate. The main exception to this rule is that inheritance is added to the bankruptcy estate and may be used to satisfy creditors. A third advantage is that no minimum amount of debt is required and bankruptcy may be filed if the debtor owns assets but faces cash flow problems. The final advantage is that it is a relatively quick proceeding, with most bankruptcies discharged within three to six months.

Chapter 7 has some disadvantages to debtors, too. The first is that the debtor is not in charge of distributing the bankruptcy estate. Instead, a trustee is appointed by the United States Trustee Program, which is a part of the Department of Justice responsible for overseeing the administration of bankruptcy cases. Trustees in Chapter 7 cases usually sell all non-exempt property, including homes and vehicles. Therefore, individual debtors risk losing a significant amount of their personal property without being able to retain any control of the process. A second disadvantage is that co-signors of any affected loans may be responsible for the full amount of the debt under the loan. Sometimes trustees will prioritize payment of debts without co-signors, which may result in co-signors filing for bankruptcy as well.

Chapter 11 Reorganization

The goal of reorganization under Chapter 11 is to restructure the debtor’s finances and pay creditors’ claims over an extended period of time. Ultimately, the goal of Chapter 11 is to help debtors remain in business.

One advantage of Chapter 11 bankruptcies is that a trustee is not always required. If the debtor is cooperative and able to distribute assets according to the court-approved plan, then a trustee will not be appointed. However, if the debtor is uncooperative or lacks the skills necessary to successfully implement the bankruptcy plan, a trustee may be appointed.

Another advantage is that the debtor and creditors are allowed to propose payment plans to the bankruptcy court. Although the court is not required to adopt the plans, creditors are given an opportunity to vote on a proposed plan before the court decides whether to adopt it. This gives the interested parties an opportunity to create a reasonable solution that addresses the needs of both the debtor and creditors.

A final advantage of Chapter 11 is that it provides an expedited process for small business bankruptcies. The process allows small businesses to resolve their bankruptcies quickly so that they can move forward with their reorganization plans.

Chapters 7 and 11 have an interesting relationship. Businesses may file for bankruptcy under Chapter 11 with an intent to reorganize their debt and stay in business. However, if creditors do not believe that reorganization is viable for a business, they may request the court to convert the bankruptcy to Chapter 7. For example, in March 2016, Sports Authority filed for Chapter 11 bankruptcy. When creditors discovered the extent and nature of Sports Authority’s debt, they successfully requested the court convert the bankruptcy to Chapter 7. When the court granted the creditors’ request, Sports Authority was forced to liquidate its assets and wind up its affairs.

Chapter 13 Reorganization

Chapter 13 bankruptcy is only available to individual debtors. The purpose of Chapter 13 is to adjust the debts of individuals whose debts are small enough and income is large enough that a substantial repayment plan is feasible. In other words, the proceedings help individuals keep most of their existing assets but must use most, if not all, future income to pay off debts.

A primary advantage of Chapter 13 is that it allows individual debtors to stop the cycle of compound interest on debts from spiraling to a point where they are forced to file for bankruptcy under Chapter 7. Chapter 13 provides for an automatic injunction against collection efforts and wage garnishments, except for child support. And debtors are allowed to keep their property as long as they make the required payments under the bankruptcy plan.

One characteristic of Chapter 13 is that it provides for long periods to pay off debts. The average payment plan under Chapter 13 lasts between 3 to 5 years. This can be either an advantage or disadvantage to a debtor. On one hand, it allows for reasonable payment plans that balance the interests of the debtor and creditors. On the other hand, it ties up future income for a long time to pay off existing debt.

24.3 Bankruptcy Proceedings

Although there are some differences among Chapter 7, 11, and 13, bankruptcy proceedings have some common characteristics.

Bankruptcy Estate

The bankruptcy estate is the debtor’s legal and equitable interests in property at the time a bankruptcy petition is filed. Under the bankruptcy code, the bankruptcy estate includes real and personal property, bank and investment accounts, life insurance benefits, and inheritances. Debtors are allowed to claim some property as exemptions. In other words, certain property is returned to the debtor from the bankruptcy estate.

Common exemptions include:

- Equity interest in a residence, vehicle, and personal property (up to a certain value);

- Prescribed health aids, such as walkers and wheelchairs;

- Benefits, such as social security, unemployment compensation, public assistance, disability benefits, and child support;

- Retirement funds and pension (up to a certain value); and

- Education savings accounts.

Debts that Cannot be Discharged

Bankruptcy does not discharge all debts. There are some types of debts that a debtor remains legally liable for, regardless of being bankrupt.

Common debts that are not discharged through bankruptcy include:

- Child support and maintenance to a former spouse;

- Taxes and fines payable to a governmental agency;

- Debt incurred by fraud;

- Liability for intentional torts;

- Liability for accidents caused while driving while intoxicated;

- Student loans less than 5 years old; and

- Debts owed under a prior bankruptcy plan.

Grounds for Denying Bankruptcy Relief

Discharge of debts through bankruptcy is a privilege, not a legal right. Therefore, Congress specified certain situations in which a debtor is not eligible for bankruptcy relief. These grounds include:

- Fraudulent transfers;

- Keeping inadequate records;

- Committing a “bankruptcy crime,” such as perjury, making a false claim, bribery, and withholding or destroying records;

- Failure to explain a loss or deficiency of assets;

- Refusing to testify in the proceedings or to obey a court order; and

- Failure to complete the required consumer credit education course.

The grounds for denying a discharge in bankruptcy usually exist when wrongful conduct occurs by the debtor, the debtor does not fully cooperate in the proceedings, or the debtor does not maintain sufficient records to allow the proceedings to move forward.

Procedural Steps

Bankruptcy proceedings begin when a debtor or creditor files a petition for bankruptcy with the bankruptcy court. Married couples may file a joint petition. The petition lists the identity of the debtor(s), the identity of all secured and unsecured creditors, the property in the bankruptcy estate, any claimed exemptions, and a statement of affairs of the debtor.

Filing a bankruptcy petition results in an automatic stay, which prevents creditors from beginning or continuing collection efforts against the debtor. The stay is designed to protect both the debtor and creditors. Debtors are protected from collection efforts while they focus on creating plans for reorganization and repaying debts. Creditors are protected from assets being transferred to prevent payment of debts and the inequitable distribution of assets among creditors.

The bankruptcy court has decision-making power in bankruptcy cases. The court decides matter connected with a bankruptcy case, from the filing of the petition through final discharge of the bankruptcy. The court determines whether a debtor is eligible for bankruptcy, approves the bankruptcy plan, and oversees the bankruptcy proceedings.

If a trustee is required or needed, a trustee will be appointed by the U.S. Trustee and approved by the bankruptcy court. The trustee takes charge of and administers the debtor’s estate during bankruptcy proceedings. A trustee is the representative of the estate and is responsible for prioritizing and satisfying creditors’ claims. To achieve this goal, trustees may hire professionals such as accountants, attorneys, and appraisers.

The main job of the trustee is to execute the bankruptcy plan. The bankruptcy plan is a detailed plan of action for the liquidation or reorganization of the debtor’s assets and to satisfy creditors’ claims.

Bankruptcy plans identify and prioritize debts. The first debts to be paid off are to secured creditors who have interest is a particular property to “secure” the debt. Mortgages, car loans, and liens are common examples of secured debts. If the individual or business defaults on the loan payments, a secured creditor may force the debtor to sell or forfeit the property to satisfy the debt. The second category of debts are to unsecured creditors, who do not have an interest in any particular property.

The bankruptcy code prioritizes claims from unsecured creditors as follows:

- Child support and maintenance to a former spouse;

- Administrative expenses of the bankruptcy estate, including the trustees’ and accountants’ fees;

- Creditors who loan money to the debtor during the bankruptcy;

- Wages, salaries and commissions;

- Contributions to employee benefit plans;

- Consumer deposits;

- Specific taxes and governmental fees;

- Wrongful death and personal injury claims; and

- General creditors.

Once the bankruptcy plan is completely implemented, a discharge occurs. A bankruptcy discharge releases the debtor from monetary obligations that existed at the time the petition was filed and ends the bankruptcy case.

24.4 Concluding Thoughts

A fundamental goal of bankruptcy is to give debtors a financial “fresh start” from overwhelming debts. This goal is accomplished through discharging debts, which releases the debtor from liability from specific debts and prohibits creditors from undertaking collection actions against the debtor. However, bankruptcy does have a cost to it. It negatively impacts a debtor’s credit history and impacts an individual or business’s ability to get a loan or build up assets again. Businesses also run the risk of liquidation and the business terminating, even if intending only to reorganize. Before filing for bankruptcy a business should consider if there are better alternatives available to manage and pay off their debt.